Opportunities at MCCCB

Now Hiring: Resident Imam

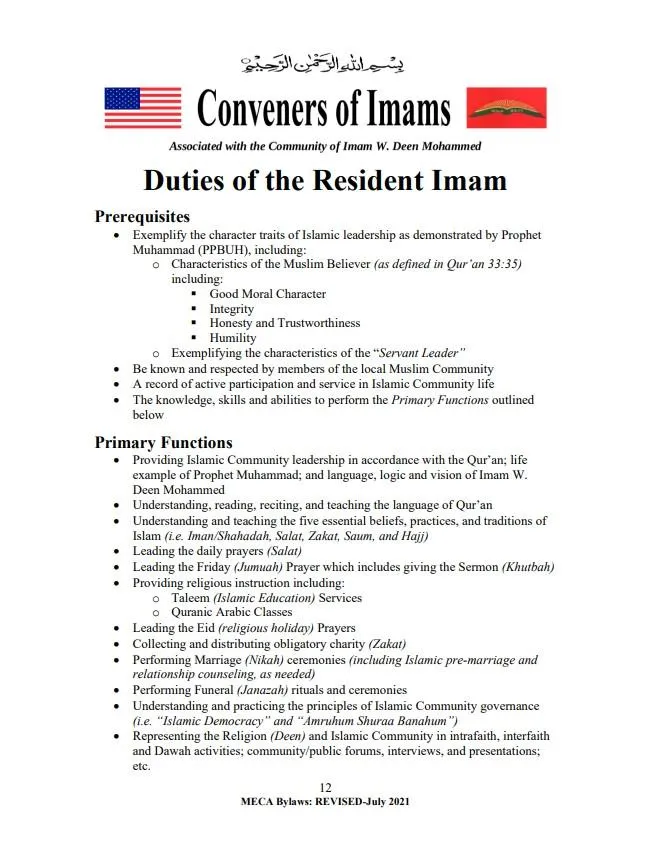

The Muslim Community Cultural Center of Baltimore (MCCCB) is seeking a dedicated and visionary Resident Imam to succeed Imam Earl El-Amin. We are looking for a leader who embodies the character, scholarship, and community spirit of Islamic leadership—grounded in the Qur’an, the Sunnah of Prophet Muhammad (PBUH), and the logic and vision of Imam W. Deen Mohammed.

📌 Highlights of the Role

Lead daily and Jumu’ah prayers

Provide Islamic education and counseling

Represent MCCCB in interfaith and community forums

Guide the spiritual and social growth of the congregation

Deep knowledge of Qur’an, Hadith, Seerah, and Islamic history required

Apply for the Position of Resident Imam

We are now accepting applications for the role of Resident Imam at MCCCB. If you meet the criteria outlined in the Imam Duties & Qualifications, we invite you to complete the form below.

I have reviewed the Resident Imam Role Description and confirm I meet the qualifications.

Opportunities at MCCCB

Now Hiring: Resident Imam

The Muslim Community Cultural Center of Baltimore (MCCCB) is seeking a dedicated and visionary Resident Imam to succeed Imam Earl El-Amin. We are looking for a leader who embodies the character, scholarship, and community spirit of Islamic leadership—grounded in the Qur’an, the Sunnah of Prophet Muhammad (PBUH), and the logic and vision of Imam W. Deen Mohammed.

📌 Highlights of the Role

Lead daily and Jumu’ah prayers

Provide Islamic education and counseling

Represent MCCCB in interfaith and community forums

Guide the spiritual and social growth of the congregation

Deep knowledge of Qur’an, Hadith, Seerah, and Islamic history required

Apply for the Position of Resident Imam

We are now accepting applications for the role of Resident Imam at MCCCB. If you meet the criteria outlined in the Imam Duties & Qualifications, we invite you to complete the form below.

I have reviewed the Resident Imam Role Description and confirm I meet the qualifications.

Volunteer With Us

We’re calling on volunteers to help gather grant materials, organize community initiatives, and support MCCCB's future. Your time makes a difference.

Subscribe to our newsletter

Get notified of new products, services, educational information, and promotions directly to your inbox.

Latest News

Stay Informed. Stay Connected.

Catch up on the latest updates from MCCCB, including upcoming events, community initiatives, and restoration progress.

Why Didn’t Anyone Tell Me? Understanding the Layers Behind Property Inspections

You’re a homeowner. Someone knocks on your door or is spotted taking pictures of your house, and you’ve never heard of them. You call your mortgage company, and they don’t have a record of it—or they mention a different company you’ve never heard of either. It’s confusing, frustrating, and happens far more often than people realize.

Here’s why: there are multiple layers of companies involved in an exterior-only occupancy property inspection, and each layer can pass responsibilities along without ever speaking directly to you.

Let’s break it down using a real-world example from a subcontractor’s point of view.

The Signature Pros: Your Point of Contact

When I show up, I’m not randomly taking photos. I’ve been contracted by a field servicing company to complete an exterior occupancy inspection. But I’m not their employee—I’m a subcontractor. My business is The Signature Pros, and we provide professional services to many field servicing companies that need reliable help in the field.

Who Are These Field Service Companies?

A Field Services is a national field inspection management company, and they exist by the hundreds. They do not own your loan. They do not service your loan. They’re the middleman who handles fieldwork for clients across the country. This includes inspections, property preservation, and even maintenance services for banks and loan servicers.

Who Hires These Field Service Companies?

The field servicing company may have been hired by a loan servicer. That servicer could be:

AmeriHome Mortgage

Midland Mortgage

Or one of hundreds of servicing companies that manage payments and default operations on behalf of your lender

Often, loan servicing is outsourced. Even if you originally signed with one lender, the company that now collects your payments or manages your account may be entirely different.

So Who’s Really Behind All of This?

Here's how the layers often stack up:

You (the Homeowner)

Original Lender or Bank (the institution that gave you the loan/mortgage)

Loan Servicer (the company now managing your loan)

Asset Management Company (oversees inspections, defaults, and foreclosures)

Field Service Company (there are hundreds)

Subcontractor/Inspector (like The Signature Pros—you meet us at your door)

Each of these layers may be working under contracts, not direct employment. And each layer might not communicate with the one below it—or you.

Where Does the Chain Stop?

The final authority is the investor or lienholder on the mortgage—often:

A bank

A government-sponsored entity (like Fannie Mae or Freddie Mac)

A private investor owns the note, and everyone beneath them, including your servicer, is acting on their behalf.

Why Communication Breaks Down

Too many layers: Information doesn’t always travel down the chain.

Privacy regulations: Subcontractors (like The Signature Pros) cannot share specifics because we do not have them to share. Subcontractors receive an order with the property address, instructions on what to say if an interaction occurs and what to take pictures of, the name of the lender or loan servicing company, the loan number, the name of the realtor/broker if the home is being sold or inspected on the inside, and that’s it.

Outsourcing overload: Companies are juggling thousands of properties at once, so personalization takes a back seat.

Ownership confusion: Your loan may have been sold multiple times.

What You Can Do

✅ Ask for identification (you’re entitled to know who is at your home)

✅ Get everything in writing from your loan servicer if you’re unsure about next steps

✅ Review your Deed of Trust—it may allow inspections without notification

✅ Know your chain of command—start with your servicer and work up

Final Word

So when you see someone with The Signature Pros uniform outside your home with a clipboard or camera phone, know this: the inspector is not trying to be intrusive. They’re part of a long chain, carrying out a task that began well above their level, often without full context.

Please keep in mind that inspectors are limited in what they can share, as they are not given the specific details of your loan or personal situation. Your circumstances are confidential, and it would be a violation of privacy laws for inspectors to access sensitive borrower information.

Inspectors are simply there to complete a specific job assigned by the mortgage servicer—not to pass judgment, intrude, or make you feel uncomfortable. Their presence is about compliance, not confrontation.

✨ The best thing you can do as a homeowner is stay informed, ask questions, and review your Deed of Trust so you understand what’s allowed—and why. Knowledge is protection. And in situations like this, it’s your most powerful tool.

💼 Need help understanding your homeowner rights or want guidance on your mortgage situation? Ask us about enrolling in our affordable legal support plan—giving you access to experienced attorneys who can help you navigate tough questions, review your documents, and offer peace of mind when you need it most.